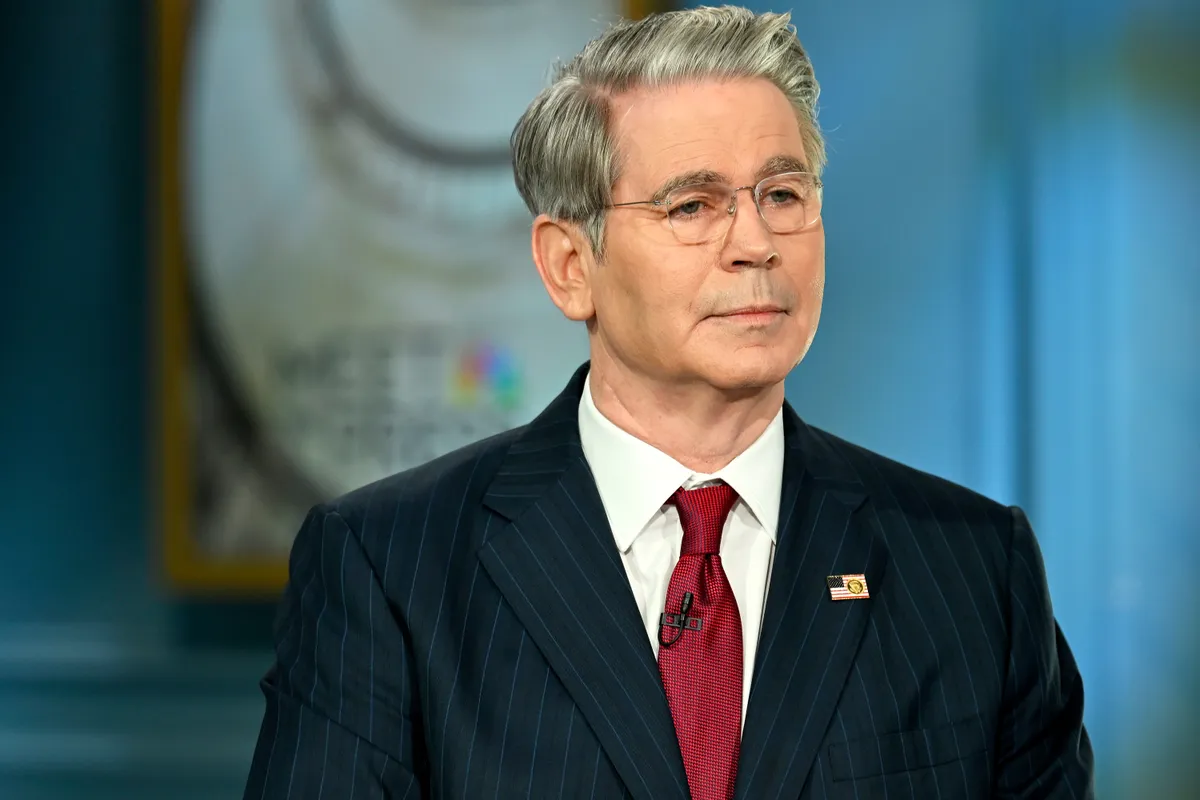

After Donald Trump’s comments about Walmart’s price hike announcement, US Treasury Secretary Scott Bessent spoke with the CEO of the retail corporation about Trump’s tariffs.

Due to the higher costs from the tariffs implemented by President of the United States (POTUS) Donald Trump, retail corporation Walmart is set to raise its prices on goods. Responding to the news, Trump penned a strongly worded message addressed to Walmart, chastizing the company and warning the retailer that he will be keeping tabs on its moves.

Walmart, long lauded for its ability to keep prices relatively low, now finds itself making a difficult pivot. The announcement to increase prices followed the release of Walmart’s first-quarter earnings, which showed a dip in profit despite steady sales.

The company earned $4.45 billion, or 56 cents per share, in the quarter ending April 30, 2025, down from $5.10 billion, or 63 cents per share, a year earlier. Adjusted earnings per share came in at 61 cents, reportedly beating analysts’ expectations of 58 cents.

Revenue rose by 2.5 percent to $165.61 billion. At the opening bell on a Thursday, Walmart shares fell by 4 percent. Despite strong quarterly sales and a projected second-quarter sales growth of 3.5 to 4.5 percent, Walmart withheld a profit outlook for the quarter, citing ongoing instability in US tariff policy.

While the company maintained its full-year guidance, issued in February, executives emphasized that the “chaotic environment” created by shifting trade regulations made near-term forecasting unreliable.

According to Walmart’s CEO Doug McMillon, price increases had already begun as early as April and accelerated further in May, particularly as the company prepared for the back-to-school retail season.

The tariffs — especially those on Chinese imports — are beginning to erode the very foundation of Walmart’s low-cost retail model.

Though the Trump administration’s previously threatened 145 percent, import taxes were scaled back to 30 percent in a new deal announced Monday (May 12, 2025). Higher tariffs have merely been paused for 90 days, creating a temporary window of relief. Many retailers, including Walmart, are scrambling to import products such as shoes, toys, clothing, and electronics before duties spike again.

McMillon noted that while the company sources general merchandise from dozens of countries, China remains a major supplier in specific categories like toys and tech.

Tariffs are also driving up prices on food staples like bananas, avocados, coffee, and roses due to levies on imports from Costa Rica, Colombia, and Peru. Although groceries, which account for roughly 60 percent of Walmart’s US business, have helped buffer the impact, the company is not fully insulated.

In some departments, Walmart has begun absorbing costs internally, delaying price hikes to maintain consumer trust. Additionally, the retailer is working with suppliers to modify product components — for example, replacing tariff-hit aluminum with alternative materials such as fiberglass.

Consumers, meanwhile, appear to be growing more frugal amid the shifting economic terrain. Government data, released Thursday, signaled softening sales growth across the retail industry. Walmart echoed that trend, observing that customers are becoming “cautious and selective” in their purchasing behavior.

While the company saw strong performance in groceries, health, and wellness items, sales in home goods and sporting equipment weakened. That dip was offset by increased demand in categories like automotive products, toys, and children’s apparel.

Notably, Walmart’s US comparable sales rose 4.5 percent in the second quarter — a slight slowdown from the 4.6 percent increase in the quarter prior, and the 5.3 percent growth reported in Q3 2024.

On the digital front, Walmart’s global e-commerce sales jumped 22 percent, improving from a 16 percent gain in the previous quarter.

As one of the first major US retailers to report quarterly results, Walmart’s earnings have become a bellwether for the state of the American consumer. The earnings also present a revealing case study on how Trump’s tariff strategy is reshaping the retail landscape.

While companies like Amazon were able to preemptively import inventory ahead of the policy rollout, Walmart is navigating these headwinds in real time, forced to balance price pressures against its long-standing promise of affordability.

President Trump wasted no time issuing a sharp rebuke to Walmart following its announcement to raise prices. Posting on Truth Social, he directly challenged the retailer’s rationale, accusing the company of using his tariff policies as a scapegoat.

“Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain,” Trump wrote. Citing the company’s strong financial performance, he added, “Walmart made BILLIONS OF DOLLARS last year, far more than expected.”

“Between Walmart and China [sic] they should, as is said, ‘EAT THE TARIFFS,’ and not charge valued customers ANYTHING,” he went on to declare.

In a warning that struck a more personal tone, he concluded, “I’ll be watching, and so will your customers!!!” The post added fuel to an already simmering economic debate, with Trump doubling down on his protectionist policies, while publicly pressuring one of the nation’s most influential retailers to absorb the costs without raising prices.